How EMI on UPI for Ecommerce is Making Big Purchases Easier

EMI on UPI for ecommerce lets shoppers buy online in easy installments without a credit card. Learn how UPI EMI works, its benefits, and Snapmint’s role.

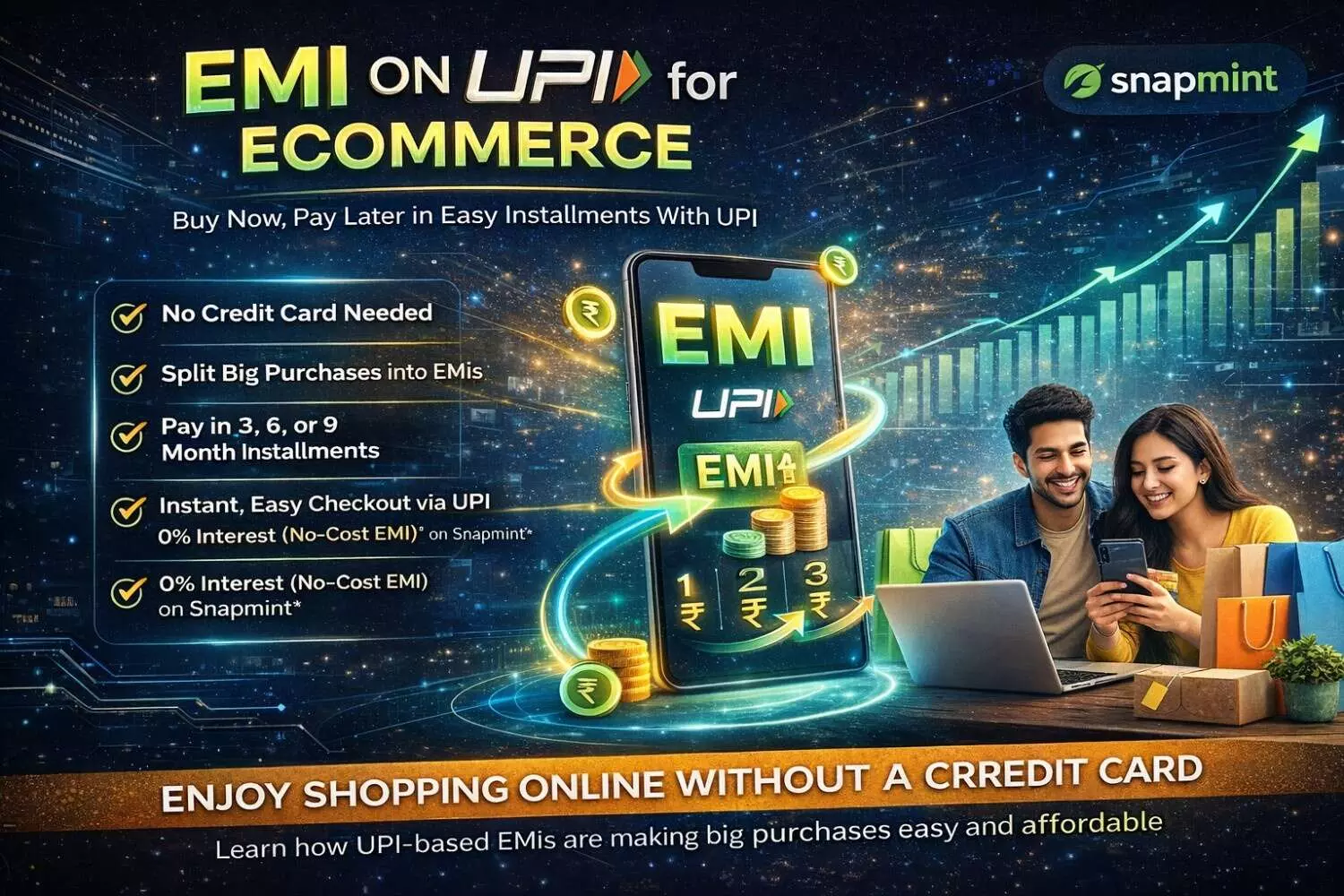

image for illustrative purpose

India is transforming at a rapid rate in terms of online shopping. Today, EMI on upi for ecommerce is enabling millions of consumers to purchase more without having to pay all the money at the time of purchase. UPI-based EMI plans are transforming the checkout experience because big ticket costs are now divided into payment installments which are easy to pay.

What Is EMI on UPI for Ecommerce?

EMI on UPI for ecommerce allows consumers to divide the amount directly to them over a monthly instalment using UPI. This is unlike the traditional EMIs that expect a person to use a credit card hence this option enables the shopper to use his bank account or debit card. It is an easy, quick, and safe procedure.

One of the sites that promote this kind of model is Snapmint, which provides EMI shopping without the involvement of a credit card. Snapmint is demonstrating the ability of fintech to eliminate financial boundaries by facilitating installments on day-to-day fund transfers on UPI.

Why It’s Becoming Popular?

Emi on UPI for ecommerce is picking up speed due to several reasons:

Credit Card Alternative: Indians do not carry credit cards, but almost all people use UPI. EMI through UPI provides installment to a significantly broader market.

Convenience: It is made easy with quick approvals and instant payment of the UPI.

Affordability: Buyers can pay in installments with no heavy charges such as no-cost EMI.

Promotion to Sellers: Sellers of emi on upi for ecommerce business experience a boost in average order value and reduced abandoned carts.

Benefits of EMI on UPI for Ecommerce Consumers

Financial Flexibility: Customers are allowed to select an installment plan of 3, 6 or 9 months in lieu of paying a large amount of money at once.

Inclusivity: The non-credit cardholders are also entitled to EMI benefits.

Quick Checkout: The process of payments is fast and smooth, since UPI is really fast and reliable.

Budget Management: This is aided by the instalments that allow one to plan monthly without exceeding.

These benefits are enhanced by Snapmint, which includes cardless EMI, installment without charges, and an expanding list of merchants including electronics, fashion, and lifestyle market segments.

Challenges to Consider

Although emi on upi for ecommerce is thrilling, as a shopper, one must know a couple of facts:

Eligibility: Approaches can be made based on bank history or ability to repay without the use of credit cards.

Don’t miss small charges: certain sites can impose extra charges - never overlook the terms.

Excessive Spending Dangers: Instalments have the capacity to lure out a consumer to purchase more, which is beyond his/her financial means.

Refunds and Returns: Cancelled orders will take some time to show up in EMI schedules.

Practical Tips for Consumers Using EMI on UPI for Ecommerce

Never miss out on the following tips while making your big purchase by EMI on UPI for your ecommerce bestsellers:

Do not forget to verify the conditions of the EMI plan. The number of installments, the interest rate (or not) and processing fees.

Check the policies of merchant and delivery. Make sure there are good return policies, reliable delivery by the seller.

Take an EMI plan that one can afford to repay; budget your monthly finances.

Remember EMI payments ahead of time UPI autopay or reminders will help but it is best to watch over.

By purchasing via Snapmint, it is essential to know the functionality of eligibility, credit limit, and UPI selection on your profile.

Why Does Snapmint Stand Out?

Snapmint supports emi on upi for ecommerce by:

Providing 0% EMI on UPI for ecommerce best sellers.

Opening cardless EMI to anyone with UPI.

Collaborations with the leading e-commerce brands, which makes it convenient to buy in categories.

This model renders expensive products such as smartphones to household devices much affordable.

Conclusion

Your online shopping experience will be redefined by EMI on UPI for ecommerce. It allows you to buy large items without straining your finances while allowing sellers to expand due to low-paying flexibility. Platforms such as Snapmint are already spearheading this change and show that credit-free EMIs are the future of online shopping.

In case you have been waiting to make a big purchase, it is time to consider emi on upi for ecommerce as an amazing way. Try the convenient EMI facilities of Snapmint and see how easy, inclusive, and stress-free large purchases can be.